Family SMEs in the UK: Latest findings from the Small Business Survey 2024

New analysis of LSBS 2024 data on how common family-owned SMEs are and how they are performing in the current environment.

By Martin Kemp, Family Business Research Foundation

Key findings at a glance

73 per cent of SME employers are family-owned, down two percentage points on 2023 and six points on 2022.

Around 72 per cent of SME employers are both family-owned and family-managed, with the owning family actively involved in running the business.

Family firms still dominate across all size bands, but the share of medium-sized employers that are family-owned dropped from 56 to 51 per cent between 2023 and 2024.

The pattern suggests a modest easing from the elevated levels seen in 2020–2022, rather than a sharp structural shift away from family ownership.

The Family Business Research Foundation’s latest State of the Nation report estimated that there were about 5.13 million family businesses in the UK in 2023—more than 93 per cent of all firms and roughly 1.05 million with employees (Cebr and FBRF, 2025). The report also estimated that family businesses generated around £2.8 trillion in turnover and £985 billion in gross value added (GVA) in 2023, providing 15.8 million jobs and paying around £401 billion in wages (Cebr and FBRF, 2025). Such firms were estimated to contribute about £422 billion in taxes in 2023, accounting for over half of private-sector employment in the UK. These figures underline the economic significance of family‑run firms and why it is important to monitor the demographics and performance of this critical part of the UK economy.

The UK Government’s Longitudinal Small Business Survey (LSBS) is the main source of data on the prevalence and characteristics of family-owned small and medium‑sized enterprises (SMEs) in the UK [1]. This short report summarises the results from the latest LSBS on family-owned SME employers, drawing on data published by the Department of Business and Trade (DBT) in September 2025 (DBT, 2025a, 2025d).

The first section of this report summarises the 2024 survey and methodology, including an explanation of how family businesses are identified in the LSBS. This is followed by a summary of the latest evidence on how common family ownership is among SME employers, and an analysis of how the prevalence of family ownership in the UK has changed over recent years. The final section presents updated evidence on the prevalence of family ownership and management, and how family ownerships among SMEs varies by firm size, sector and geographically.

About the Longitudinal Small Business Survey 2024

In the 2024 LSBS, SMEs in the UK were surveyed between 18 October 2024 and 16 May 2025, covering businesses with 1–249 employees (SME employers) and micro businesses without employees (DBT, 2025b). The sample comprised 10,611 businesses in total, of which 8,415 were SME employers. Cross-sectional analysis of the survey data used a weighted sample of 8,396, weighted to reflect the UK’s population of SME employers by size, sector and UK nation (DBT, 2025a, 2025b). The 2024 questionnaire was very similar to that used in 2023, facilitating comparisons across years (DBT, 2025b).

The LSBS collects data on business performance, finance, innovation, regulation, workforce and expectations and is administered via telephone using computer‑assisted telephone (CAT) interviewing methods. Weights are applied to the data to correct for unequal sampling probabilities and to adjust for non‑response. The 2024 technical report and panel report (DBT, 2025b, 2025c) describe these methods in detail, including how these weights were calculated. The analyses presented here use the weighted estimates published by DBT.

Identifying family businesses

The methodology and definitions used in the 2024 survey are largely unchanged from 2023. The panel report for the LSBS 2024 defines a family‑owned business as one where “a majority of the owners are in the same family.” “Majority” here means more than half; respondents are asked in the survey whether their business is family‑owned, defined in the questionnaire as “majority‑owned by members of the same family” (DBT, 2025c: 9. Definitions). Enterprises with a single owner are automatically assumed to be a family business in the LSBS, while those with two or more owners are asked if they are a family-owned business (DBT, 2025b). Businesses with no owners are automatically assumed not to be a family business (DBT, 2025b). This definition is consistent with that used in previous waves of the LSBS, ensuring the comparability of results. A follow-up question in the survey asks whether the person or family who majority owns the business also actively manages the business.

Headline findings from the 2024 LSBS

This section summarises the performance and experiences of all SME employers surveyed in the LSBS 2024. Where relevant, results are compared with those from the 2023 LSBS. All statistics in this section are drawn from the 2024 LSBS headline report unless noted otherwise.

Business performance

Just over one third (36 per cent) of SME employers surveyed reported that sales turnover increased in the previous 12 months, down from 40 per cent in 2023 and 46 per cent in 2022, while 30 per cent reported decreases and 31 per cent saw no change (DBT, 2025a).

Expectations have also softened, with only 31 per cent expecting their turnover to grow in the next 12 months, compared with 17 per cent that anticipated a fall in turnover (DBT, 2025a).

Profitability remained relatively robust with 77 per cent of SME employers saying that they made a profit or surplus in 2024, roughly unchanged since 2023 (DBT, 2025a).

Technology adoption and innovation

Three innovation measures are deployed in the LSBS: process innovation, product innovation (new goods or services), and service innovation. Overall, 29 per cent of SMEs with employers introduced a new or significantly improved product or service in the previous three years. This was a drop of four percentage points on 2023 (33 per cent) (DBT, 2025c).

The 2024 survey shows that 69 per cent of SME employers used some form of digital technology, such as cloud storage or e‑commerce platforms, and two thirds (65 per cent) reported using digital technology for management processes (DBT, 2025a).

Finance and investment

The 2024 LSBS found that 72 per cent of SME employers used external finance in 2024, with credit cards being the most common source used, followed by overdrafts and bank loans (DBT, 2025d).

Use of bank loans doubled from 12 per cent to 24 per cent between 2023 and 2024, while access to finance remained stable.

About a half of SMEs applied for investment finance, with most seeking funds for working capital, equipment or technology.

Obstacles and regulatory environment

Rising costs remained the dominant challenge facing SME employers in 2024. For example, 61 per cent cited taxation as a major obstacle, around half highlighted energy costs, and 40 per cent cited market competition as challenges (DBT, 2025a).

Regulatory changes, especially in employment law and health and safety requirements, were also frequently identified as obstacles by respondents.

Around three in ten SMEs surveyed (31 per cent) reported difficulties relating to Brexit, similar to the previous year’s survey (DBT, 2025a).

Workforce and skills

Employment growth slowed in 2024 among SME employers, with 24 per cent of SME employers reporting increased staff numbers compared with 23 per cent who reported decreases (DBT, 2025a).

Among SMEs with growth plans, around two thirds (62 per cent) intended to upskill their current workforce, and almost half (47 per cent) planned to recruit new staff (DBT, 2025a). However, 57 per cent indicated that rising costs constrained their plans for expansion (DBT, 2025a).

The proportion of SME employers offering training or apprenticeships remained broadly stable between 2023 and 2024, but SMEs continued to express concerns about skills gaps.

Future plans, sentiment and expectations

Business sentiment in 2024 was more cautious compared with 2023. Only 31 per cent of SMEs expected turnover growth and roughly half expected no change (DBT, 2025a).

On the investment side, many employers reported planning to adopt new technologies or enter new markets but felt constrained from doing so by cost pressures and regulatory uncertainty.

How many SMEs are family‑owned?

Kemp (2023) used LSBS data for all surveys between 2019 and 2023 to examine changes in the rate of family ownership among family SMEs over this period. The analysis is updated with newly published estimates from the 2024 LSBS (DBT, 2025d, Table 24 A12/A14 and Tables 22, 23, 24).

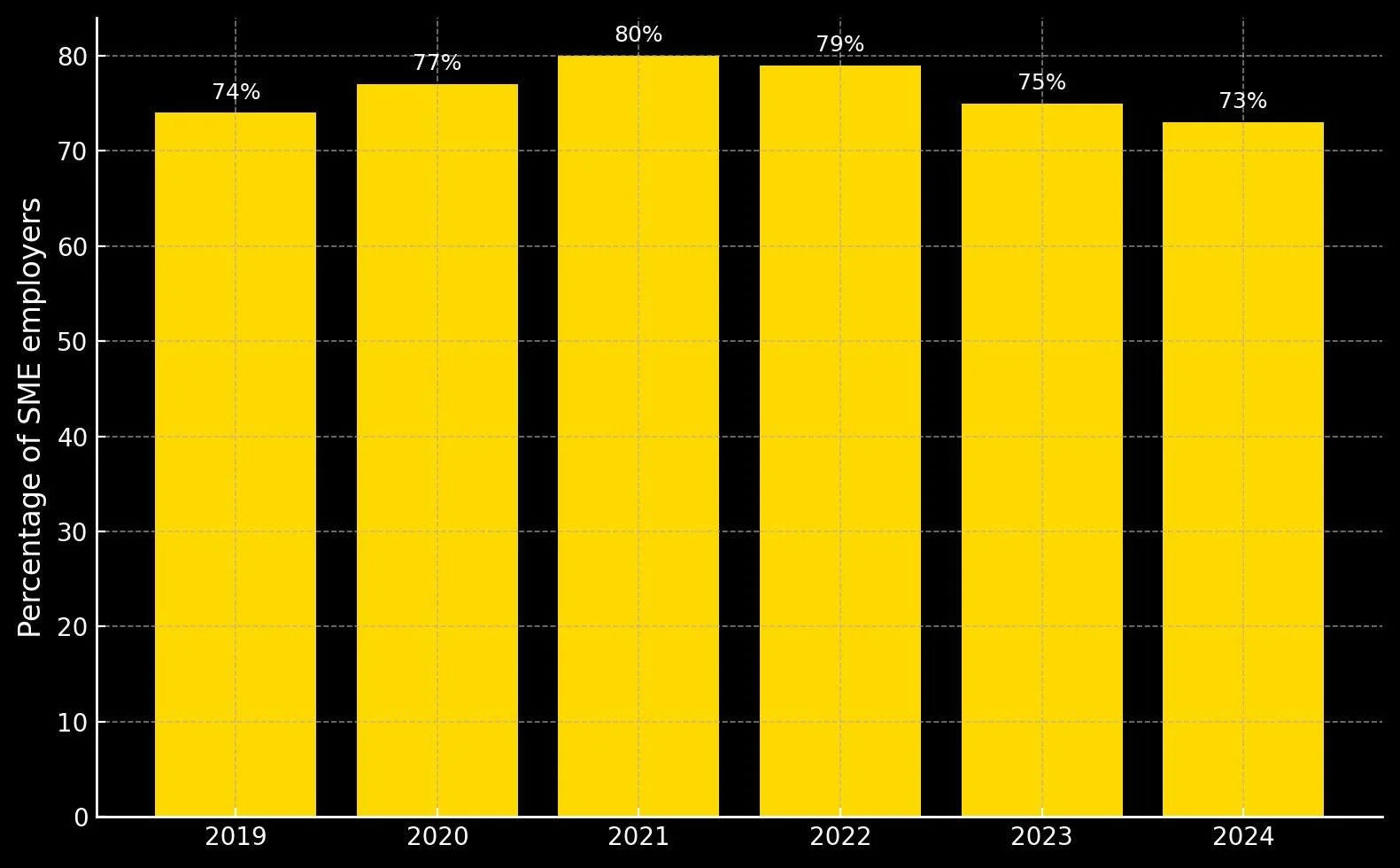

Figure 1 presents the proportion of SME employers that are family‑owned and family‑managed.

Figure 1. Ownership and Management Status of SME employers in 2024

Source: DBT, 2025d, Table 24 A12/A

Figure 1 shows that, in 2024, 72 per cent of SME employers indicated they were both family‑owned and family‑managed. Just one per cent said they were family‑owned, but not actively managed by the founding family, and 27 per cent of SME employers indicating that they were not family‑owned. This replicates the findings from the 2023 LSBS confirming that almost all family‑owned businesses remain actively managed by their owners.

Changes in family ownership among SME employers, 2019–2024

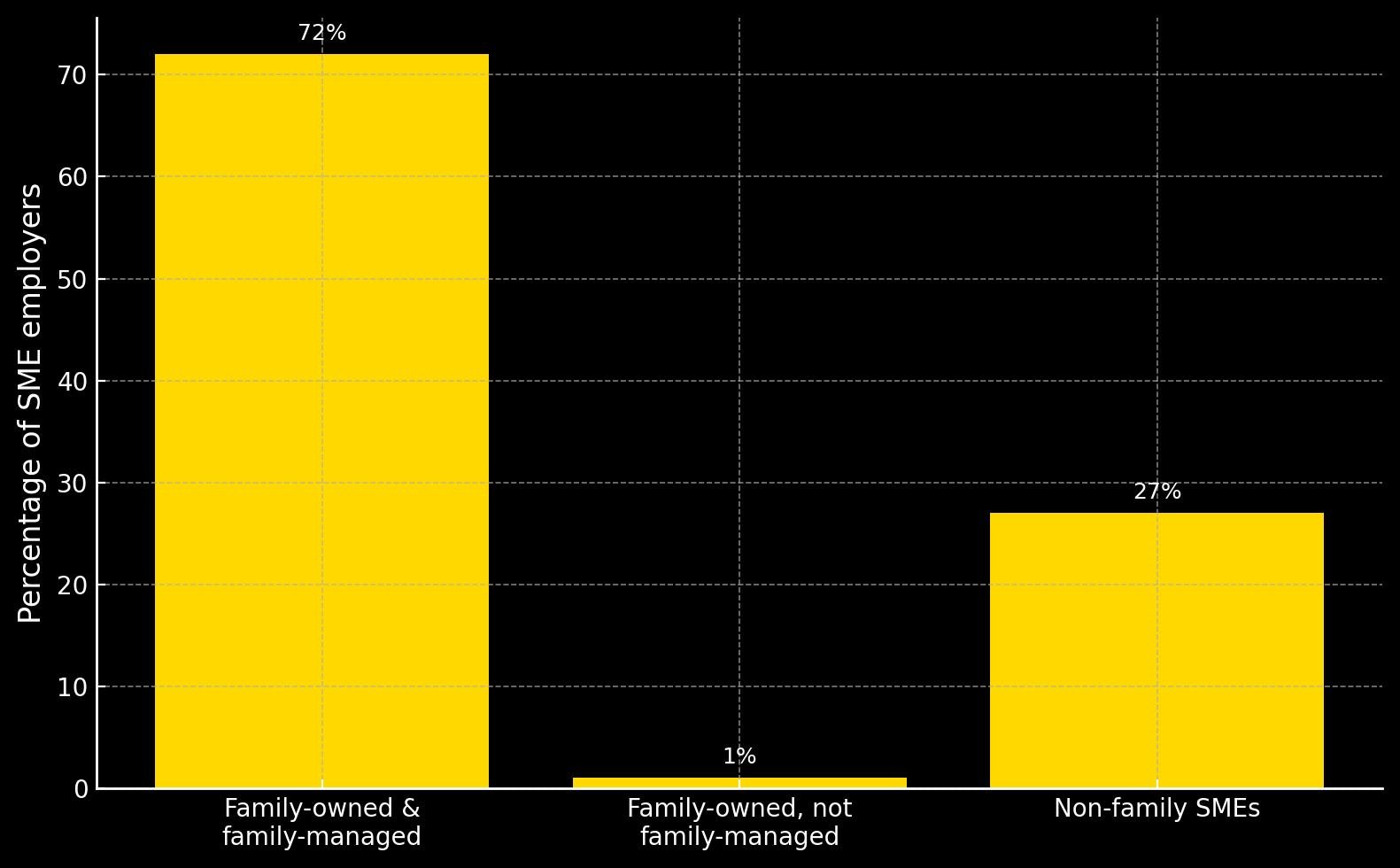

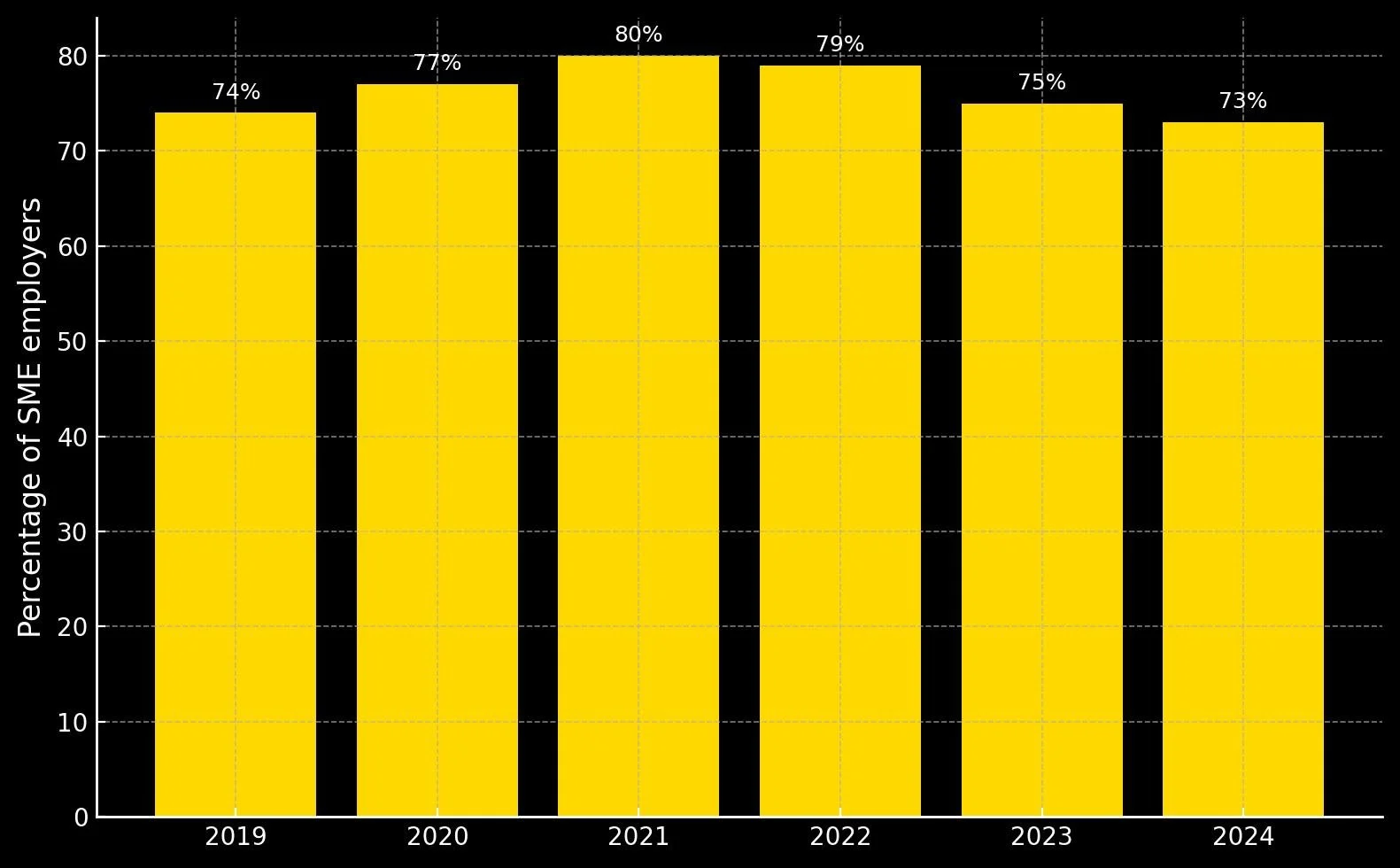

Figure 2 shows the percentage of SME employers who reported being family‑owned in each wave of the LSBS between 2019 and 2024. The data for 2019–2023 are taken from the main data tables for the LSBS for all years 2019 to 2023, while the 2024 estimate is from DBT (2025d, Table 24 A12/A14).

Figure 2. SME Employers in the UK between 2019 and 2024

Source: Kemp, 2024; DBT (2025d, Table 24 A12/A14)

Figure 2 shows that the proportion of SME employers who report being family-owned rose to a peak around 2020–2021 and then fell back to 75 per cent in 2023. Evidence from the 2024 LSBS indicates that 73 per cent of SME employers were majority-owned by the person or family who set them up, a fall of two percentage points compared with 2023 and six percentage points compared with 2022.

Given the large sample size, this downward movement may reflect more than pure sampling variation, although further analysis of the data is necessary to confirm this. In absolute terms, the shift is modest and still leaves almost three-quarters of all SME employers classified as family businesses. The declines therefore appear to be real but small, and are best interpreted as a modest easing from a previously elevated level, rather than evidence of a sharp structural shift away from family ownership.

Family ownership by business size, 2023 vs 2024

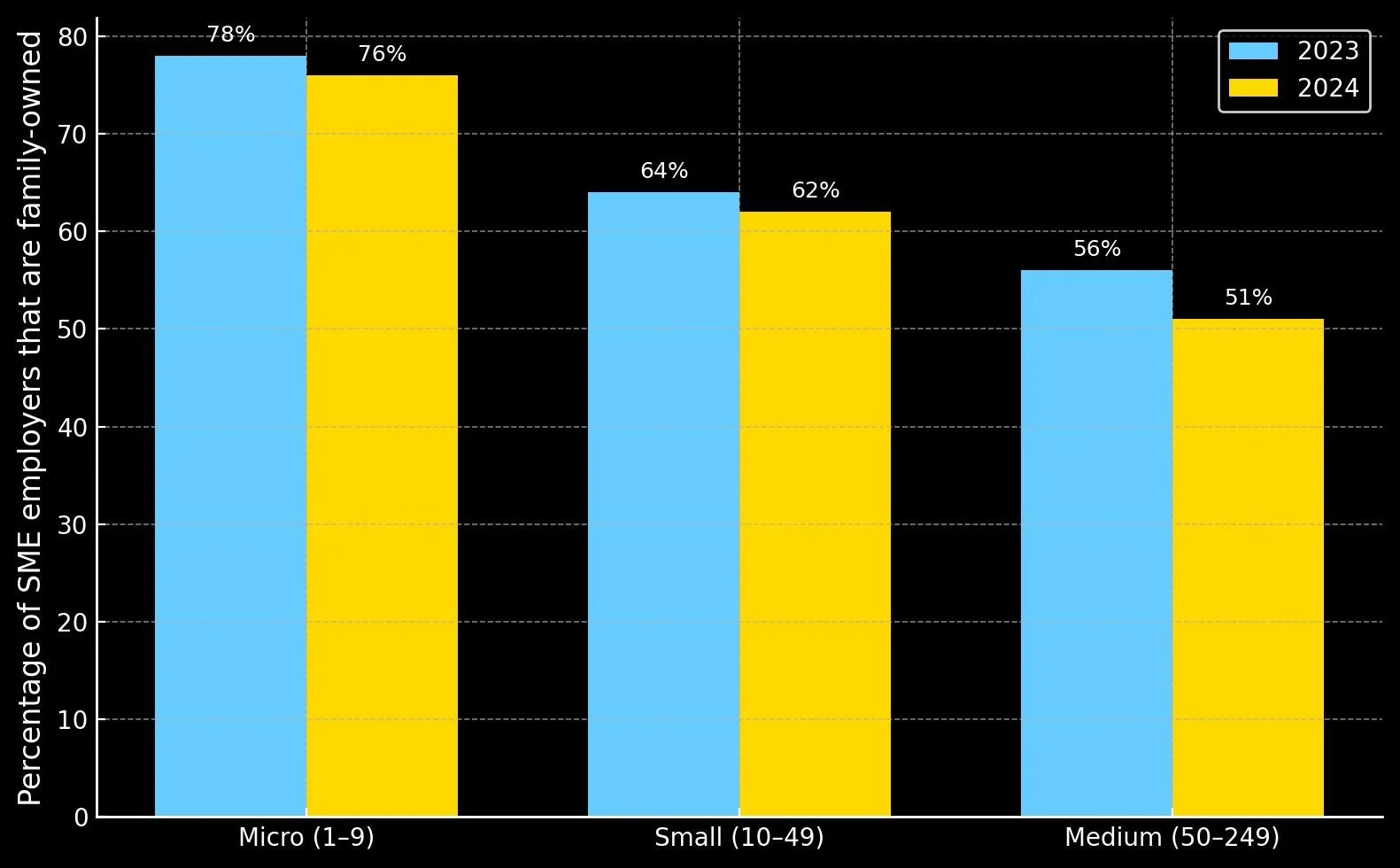

Figure 3 shows the proportion of survey participants in each employment size category that said their business was family owned.

Figure 3. Proportion of family ownership among SME employers by firm size in 2024

Source: Data from LSBS (DBT, 2025d)

Key: Micro businesses - 1 to 9 employees; Small businesses - 10 to 49 employees; Medium-sized businesses - 50 to 249 employees (DBT, 2025a: Section 15).

By employment size, the largest decline in family ownership rates between 2023 and 2024 is among medium-sized firms (from around 56 to 51 per cent), with smaller declines for micro and small firms. Because medium-sized firms are a smaller subgroup of the sample, this change should be treated cautiously. We cannot say from the published tables alone whether this drop is statistically significant; doing so would require further analysis of the survey microdata.

It should also be noted that the fieldwork for the 2023 survey took place between October 2023 and April 2024, whereas data collection for LSBS 2024 ran from October 2024 to May 2025, so these estimates relate to two distinct cross-sections of the SME employer population one year apart.

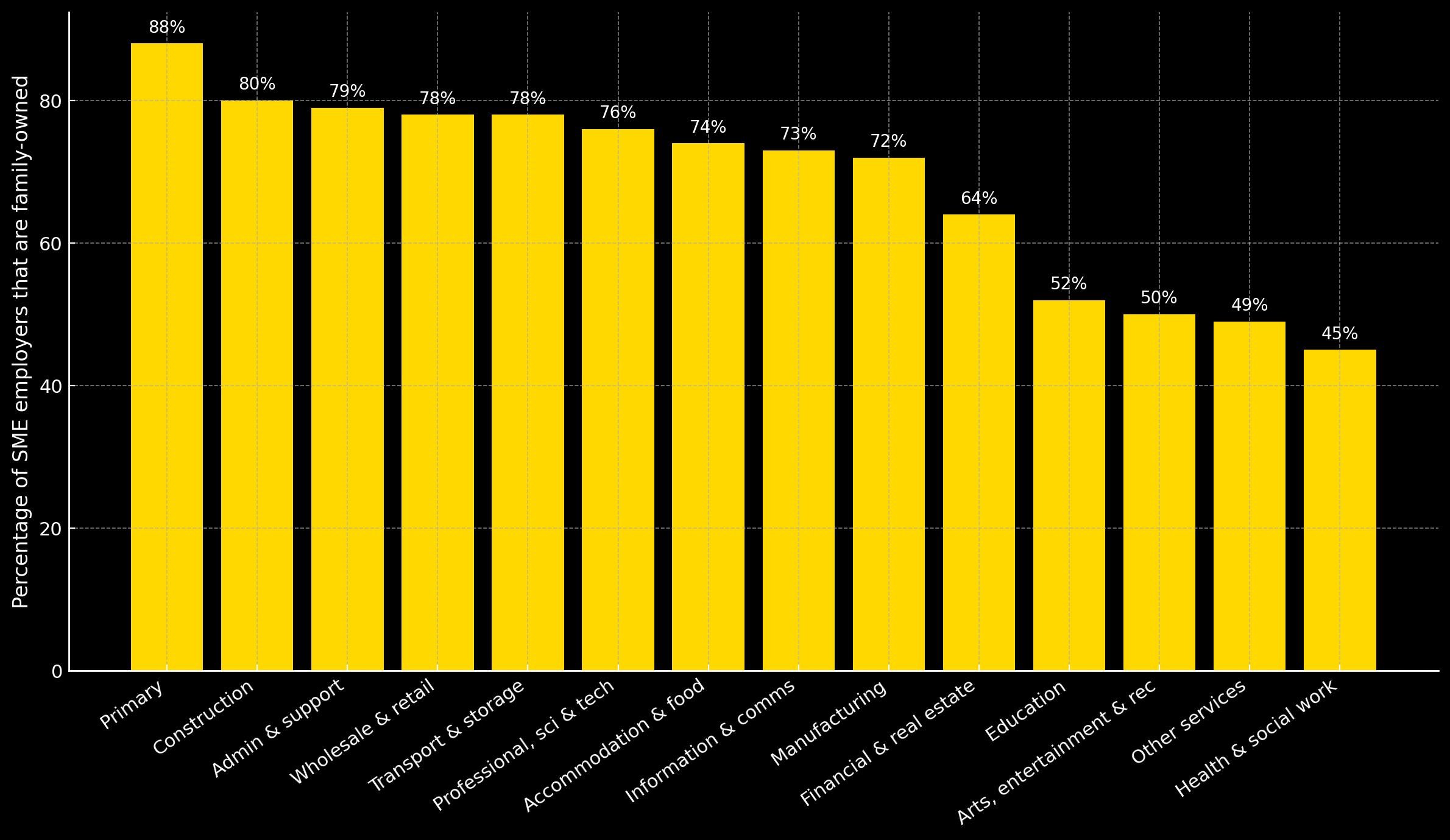

Family ownership across economic sectors

Figure 4 shows the rate of family business ownership by sector. See Note [2] and (DBT, 2025a: section 14.5) for more information on sector definitions.

Figure 4. Proportion of family ownership among SME employers by sector in 2024

Sources: Data from LSBS (DBT, 2025d); see DBT (2025a) for sector definitions.

Family ownership is highest in the primary sector [2] (88 per cent), construction (80 per cent), administration and support (79 per cent), and retail/wholesale and transport (78 per cent). It is lowest in health (45 per cent), education (52 per cent), arts/entertainment (50 per cent) and other services (49 per cent). These differences likely reflect the prevalence of owner‑managed firms in traditional sectors and the greater presence of public or non‑family organisations in health and education. The distribution is very similar to 2023, though there is a small decline in family ownership in many sectors.

Summary

Evidence from the latest LSBS shows that family-owned SMEs continue to make up a large share of the UK employer business base. Around three-quarters of SME employers were family-owned in 2024, nearly all of which are actively managed by members of the owning family.

The 2024 data suggest some early signs of possible change. The overall share of SME employers that are family-owned has edged down (compared with its 2020-2021 peak). The largest decline across size bands has been among mid-sized employers where family ownership fell five percentage points between 2023 and 2024.

Family businesses continue to dominate in many sectors, particularly primary industries, construction, retail, transport and administrative services - sectors that are central to regional economies and, in some cases, net-zero transition (for example, primary industries and construction).

The 2024 LSBS also shows that SME employers - most of which are family run - faced significant cost and regulatory pressures in 2024, with taxation, energy prices, regulations/red tape being the most commonly identified obstacles. Around three in ten SME employers (31 per cent) said they continued to view the UK’s exit from the EU as an obstacle to growth.

Given the size and importance of family-owned SMEs among the UK business population, these findings point to several priorities for further analysis using the full LSBS dataset. These include investigating the drivers of the recent fall in family ownership - especially among mid-sized employers - and exploring how family ownership is linked to performance, innovation, export activity, resilience, and how firms are managed. The 2024 results also underline the value of place-based analysis to understand how dependence on family-owned SMEs varies across UK nations and regions, and to identify where there are dense clusters of family-owned firms that play a particularly important role in providing employment and supporting sustainable livelihoods in local communities.

Notes

[1] “Small and Medium Enterprises” refer to “all businesses, firms and enterprises that have fewer than 250 employees, including those that have no employees at all. This means that in the LSBS ‘SMEs’ actually comprise businesses with no employees, micro businesses, small businesses and medium-sized businesses.” (DBT, 2025a: Section 15).

[2] UK SIC (2007) is divided into 21 sections, each denoted by a single letter from A to U (ONS, 2009). The SBS uses 14 of these one-digit SIC 2007 categories (ABDE, C, F, G, H, I, J, KL, M, N, P, Q, R, S). In the statistical release for the 2024 LSBS (DBT, 2025a: section 14.5 “Sector definitions”), sectors A, B, D, and E are combined into a single category (labelled ‘primary’). This includes (A) agriculture, fishing and forestry, (B) mining and quarrying, (D) electricity and gas, and (E) water, sewerage and waste management. KL, labelled as ‘financial and real estate’, comprises (K) finance and insurance, and (L) real estate. All other one-digit SIC sections are analysed individually.

References

Cebr & FBRF (2025) State of the Nation: UK Family Business Sector 2023/24. London: Family Business Research Foundation. Available at: https://www.fbrf.org.uk/reports/state-of-the-nation-23 [Accessed: 18 Nov 2025].

Department for Business & Trade (DBT) (2025a) Longitudinal Small Business Survey 2024: SME employers (businesses with 1 to 249 employees). London: DBT. Available at: https://www.gov.uk/government/statistics/small-business-survey-2024-businesses-with-employees/longitudinal-small-business-survey-2024-sme-employers-businesses-with-1-to-249-employees [Accessed: 18 Nov 2025].

Department for Business & Trade (DBT) (2025b) Small Business Survey 2024: methodology. London: DBT. Available at: https://www.gov.uk/government/publications/small-business-survey-2024-methodology [Accessed: 18 Nov 2025].

Department for Business & Trade (DBT) (2025c) Small Business Survey 2024: panel report. London: DBT. Available at: https://www.gov.uk/government/statistics/small-business-survey-2024-panel-report [Accessed: 18 Nov 2025].

Department for Business & Trade (DBT) (2025d) Small Business Survey 2024: SME Employers – data. London: DBT. Available at: https://assets.publishing.service.gov.uk/media/68c6957fd65a1a2a5172aaa5/LSBS_2024_Businesses_with_employees_main_data_tables_V1.xlsx

Kemp, M. (2024) How common are family businesses? Evidence from the Longitudinal Small Business Survey 2023. London: Family Business Research Foundation. Available at: https://www.fbrf.org.uk/reports/how-common-are-family-firms [Accessed: 18 Nov 2025].

Office for National Statistics (2009). UK Standard Industrial Classification of Economic Activities 2007 (SIC 2007): Structure and Explanatory Notes. Editor: Lindsay Prosser. Palgrave MacMillan. Available at: https://www.ons.gov.uk/methodology/classificationsandstandards/ukstandardindustrialclassificationofeconomicactivities/uksic2007